Publications

Read our latest reports for in-depth analysis about the market

Coming soon: Wales Healthcare Market Insight 2024

A review of the need for new build development/refurbishment across Wales.

Read More

UK Hotel Market Snapshot FY 2023

The latest report from our Hotel Consultancy team provides a full year snapshot the UK hotel market in 2023. To read the full report, click below.

Read More

Holiday Park: Market Snapshot

Our latest Holiday Park Snapshot shares an unrivalled insight to the holiday and residential park market.

Read More

Business Outlook 2024 | Hotels

Our Business Outlook Hotels 2024 report reflects on key themes, market activity and a look ahead to what 2024 may bring within the UK and Europe. The report also includes exclusive sentiment survey data from stakeholders in the Hotels sector.

Read More

Hotel Investment Overview Spain 2023

The latest report from our international hotel team provides an overview of the hotel investment market in Spain. To read the full report, click below.

Read More

Garden Centre Winter Market Snapshot

As we come to the close of 2023, our Garden Centre Winter Market Snapshot reflects on our recent activity, and opportunities for the new year across the sector.

Read More

Portugal Hotel Market Snapshot

Our latest publication analyses the evolution of hotel market in Portugal in recent years, focusing on the seven regions that make up the country.

Read More

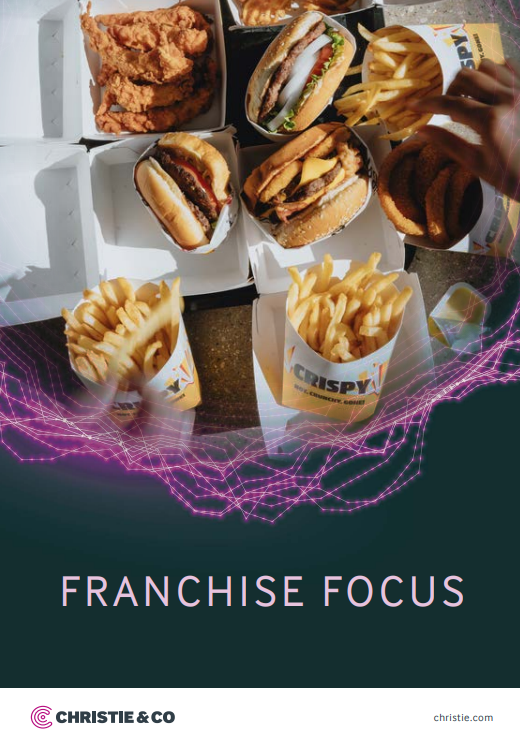

Pubs & Restaurants: Franchise Focus

The latest report from our Pubs & Restaurants team provides a look into the franchise market. To read the full report, click below.

Read More

The New Era Of Hotel Business Models

The latest report from our international hotel team provides a look into the new era of hotel business models. To read the full report, click below.

Read More

Blueprint for Early Education and Care by NDNA

We were proud to support the creation of the National Day Nurseries Association (NDNA)’s ‘Blueprint for Early Education and Care’ which highlights recommendations for the future of early education and care in England. The report launched on 17th October 2023.

Read More